Why Banks in a Peak Market

It is all too easy to forget the most elemental principle when investing money. A stock mutual fund manager must choose stocks and a bond manager must choose bonds. Putting new money to work in a particular style or sector frequently is subsumed into the expert search for the best available rather than a good investment. Diversification is then offered as a defensive mantra based on the theory that your future smaller portfolio will always recover with rebalancing and time.

Listed banks are subject to the same periods of high and low valuation as the market. Currently, though, large segments of banking are out of favor and out of sync with markets in general. The major bank indices have yet to regain highs set in 2007, whereas the broader market has charged higher. Since June 30, 2007 the S&P 500 has advanced 66% while the SNL Bank Index is still down 14%.

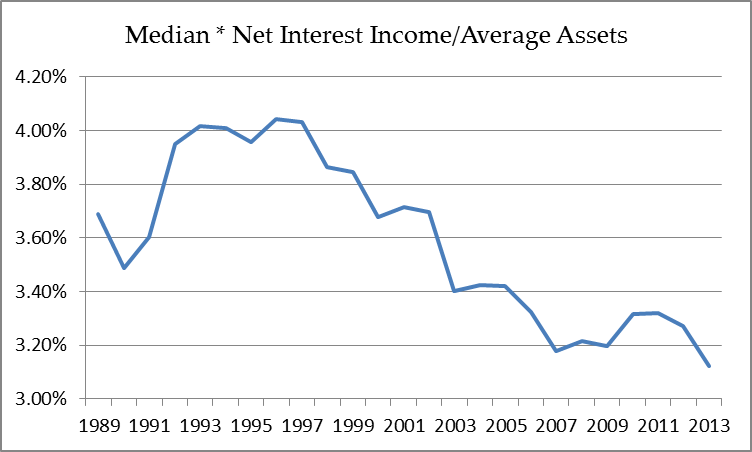

It is easy to point out why many banks remain out in the cold. Net Interest Margins for banks are slowly compressing in the ultra-low rate environment. Bank regulators are demanding more in capital and compliance while assessing ever greater fines for bad behavior. The result is overhead and legal costs have risen, squeezing profits. Many banks, large and small, are struggling and are not popular with the public.

Given all the negatives, why invest? And why will Banks provide returns higher than the S&P 500 and the overall market? There are four primary reasons.

The negative conditions present are well known, leading to low prices disconnected from franchise potential.

The S&P 500 is currently a backward focused investment and investors are looking in the rear view mirror hoping for more of the same.

Banking is a future based investment based on interest rates and economic growth.

Income is paramount. When banks recover, there is substantial potential for dividend increases as banks historically pay out 50% or more of earnings.

Not all banks are unpopular with investors. Some trade at PEs comparable with historic highs. Generally the price favored banks are regional or super regional banks with consistent ROE, high dividends and diversified revenues. Growth is further rewarded. Index investors drive even more demand into the premium stocks.

For those that need yield, which increasingly applies to all investors, a properly run and earning bank answers all questions. It delivers current cash at acceptable rates and grows at least as fast as the economy. At this phase of the investing cycle, there is one more factor in the secret sauce. Many banks will do even better as rates rise.

This is for two reasons. The first is that asset yields will move higher faster than the cost of core deposits. The second is that the economic growth implied by rising rates will drive loan balances higher. The latter is already visible. Banks are thus a unique hedge. If the economy sputters and rates stay low, their current earnings and dividends are more valuable. If rates rise then earnings will rise supporting bank stock prices. It is a very different dynamic than faced by a highly price S&P 500 Index.

There is ample historical evidence that rising rates in a growing economy can be a very good time for bank performance. Throw in a gradual shift in investor psychology as banks keep delivering profits and demonstrate extremely good credit metrics after six years of very conservative underwriting and the risk/reward is favorable.

There are more than 900 listed banks and the art will be handicapping banks currently low priced but with two great possibilities. The first is that through good management, an underperforming franchise can be improved with the twin tailwinds of better margins and increasing lending. The second is that a board of directors realizes they are pulling a Cadillac with a donkey and choose to look for a transaction to put some gas in the shareholder tank. Either path can move a bank investment from worst to first in a relatively short period of time.

The really nice thing is that you are taking advantage of a high market without actually investing into it. The gyrations of the general market can be muted by the low valuations of the fixer upper, but you can sell your renovated property into a high market.